I'll send a cheque in the post.Cousin Jack wrote: ↑Wed May 08, 2024 9:48 pmOf course you can, the price is a bit higher though.Yorick wrote: ↑Wed May 08, 2024 8:53 pmCan I pay in weekly installments over 50 years?Cousin Jack wrote: ↑Wed May 08, 2024 8:52 pm

Gimme £5k first. Your Yorkshireness will be cancelled for wasting your money.

£10 pw, with an initial deposit of £50.

Pension stuff, how's it all looking ? HAve you prepared ?

- Yorick

- Posts: 16736

- Joined: Sat Mar 14, 2020 8:20 pm

- Location: Paradise

- Has thanked: 10263 times

- Been thanked: 6885 times

Re: Pension stuff, how's it all looking ? HAve you prepared ?

- Taipan

- Posts: 13945

- Joined: Sat Mar 14, 2020 1:48 pm

- Location: Essex Riviera!

- Has thanked: 15949 times

- Been thanked: 10243 times

Re: Pension stuff, how's it all looking ? HAve you prepared ?

Equity release can be very iffy. Make sure you have a Solicitor who is well versed in its contracts and clauses...Yorick wrote: ↑Wed May 08, 2024 6:05 pm We have an amazing villa which we've chucked money at to make our dream house. Neighbour who is an estate agent says it's doubled in value since we bought it due to the improvements.

We didn't care as it's going to her kin and my nephew half and half.

But just seeing lots of stuff about equity release stuff. Even if we only get 60% of the value, that's a shitload extra to spend

I'm still a Yorkshire man, so won't be splashing out too much.

My nephew is a lieutenant in the Navy so won't be skint and getting shitloads from his dad any, so I've no guilt changing the plans.

Need a magic spell to delete my natural Yorkshireness

-

Docca

- Posts: 1017

- Joined: Fri Apr 10, 2020 7:09 pm

- Has thanked: 665 times

- Been thanked: 1163 times

Re: Pension stuff, how's it all looking ? HAve you prepared ?

I’ve gone from paying 13.5% of my monthly salary into a pension to 12.5%. Well, not just me- but everyone who used to pay 13.5%. I’m not sure why.

I’ve effectively got two NHS pensions. One from before 2007 (I think- that date could be wrong) and one after. One gives a better lump sum on retirement. It’s is all gobbledegook to me.

My wife has the standard pension that companies have to offer now.

I’ve effectively got two NHS pensions. One from before 2007 (I think- that date could be wrong) and one after. One gives a better lump sum on retirement. It’s is all gobbledegook to me.

My wife has the standard pension that companies have to offer now.

-

JackyJoll

- Posts: 3728

- Joined: Sun May 03, 2020 10:11 pm

- Has thanked: 261 times

- Been thanked: 1265 times

Re: Pension stuff, how's it all looking ? HAve you prepared ?

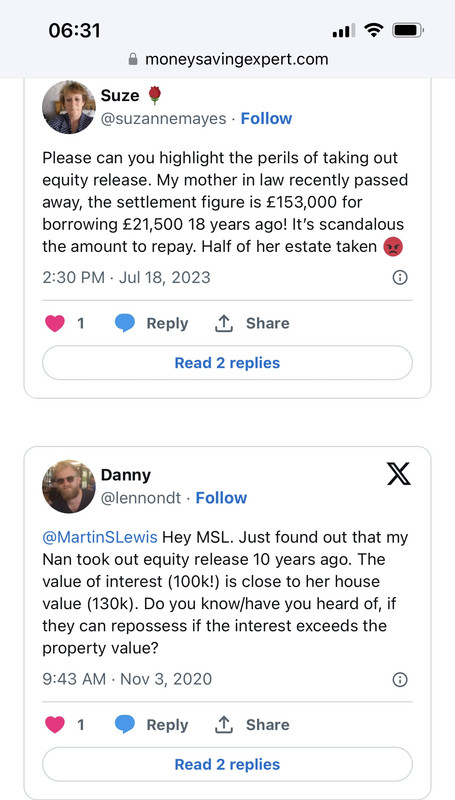

Equity release looks bloody awful!

I suppose it’s attractive to people who can’t be bothered moving to a cheaper house and want a moneylender to be the beneficiary of their estate.

https://www.moneysavingexpert.com/mortg ... y-release/

- Count Steer

- Posts: 11805

- Joined: Mon Jul 19, 2021 4:59 pm

- Has thanked: 6376 times

- Been thanked: 4751 times

Re: Pension stuff, how's it all looking ? HAve you prepared ?

Having pushed so hard to be mortgage free, I'm not likely to put myself in hock to a moneylender for 25+ years* by giving them dibs on the house.

* hopefully

Doubt is not a pleasant condition.

But certainty is an absurd one.

Voltaire

But certainty is an absurd one.

Voltaire

- Yorick

- Posts: 16736

- Joined: Sat Mar 14, 2020 8:20 pm

- Location: Paradise

- Has thanked: 10263 times

- Been thanked: 6885 times

Re: Pension stuff, how's it all looking ? HAve you prepared ?

Oh yes. We have the best on the island.Taipan wrote: ↑Wed May 08, 2024 11:10 pmEquity release can be very iffy. Make sure you have a Solicitor who is well versed in its contracts and clauses...Yorick wrote: ↑Wed May 08, 2024 6:05 pm We have an amazing villa which we've chucked money at to make our dream house. Neighbour who is an estate agent says it's doubled in value since we bought it due to the improvements.

We didn't care as it's going to her kin and my nephew half and half.

But just seeing lots of stuff about equity release stuff. Even if we only get 60% of the value, that's a shitload extra to spend

I'm still a Yorkshire man, so won't be splashing out too much.

My nephew is a lieutenant in the Navy so won't be skint and getting shitloads from his dad any, so I've no guilt changing the plans.

Need a magic spell to delete my natural Yorkshireness

- weeksy

- Site Admin

- Posts: 23417

- Joined: Sat Mar 14, 2020 12:08 pm

- Has thanked: 5450 times

- Been thanked: 13085 times

Re: Pension stuff, how's it all looking ? HAve you prepared ?

I guess as an ongoing question then within this.

IFAs, how do you find/pick one ? Are they actually worth having ?

Essentially i have a few ideas looking at my pension, mortgage and plans for when i hit 55 years. But i'd like to know if they actually have any merit.

Part of my plan is taking some/all of the 25% allocation and what to do or not do with that... If i don't spend it all, would i reinvest it and would reinvesting it yield more or less than leaving it in there for example.

I know from something some have said you don't need to take all 25% at once... but i don't know what the rules are on what and when if you want to take say 10%, 10% a few years later and 5% a few after that.. So would be nice to get some decent advice so i can plan.

IFAs, how do you find/pick one ? Are they actually worth having ?

Essentially i have a few ideas looking at my pension, mortgage and plans for when i hit 55 years. But i'd like to know if they actually have any merit.

Part of my plan is taking some/all of the 25% allocation and what to do or not do with that... If i don't spend it all, would i reinvest it and would reinvesting it yield more or less than leaving it in there for example.

I know from something some have said you don't need to take all 25% at once... but i don't know what the rules are on what and when if you want to take say 10%, 10% a few years later and 5% a few after that.. So would be nice to get some decent advice so i can plan.

- Yorick

- Posts: 16736

- Joined: Sat Mar 14, 2020 8:20 pm

- Location: Paradise

- Has thanked: 10263 times

- Been thanked: 6885 times

Re: Pension stuff, how's it all looking ? HAve you prepared ?

Weeksy, I have 4 pension plans and all deferent.

Some just let me take a 25% tax free lump.

One lets me take what I want, with 25% being tax free.

The basic rules don't change, but the plans can handle them differently.

Best to ask your pension company how they do it.

Some just let me take a 25% tax free lump.

One lets me take what I want, with 25% being tax free.

The basic rules don't change, but the plans can handle them differently.

Best to ask your pension company how they do it.

- Cousin Jack

- Posts: 4452

- Joined: Mon Mar 16, 2020 4:36 pm

- Location: Down in the Duchy

- Has thanked: 2550 times

- Been thanked: 2285 times

Re: Pension stuff, how's it all looking ? HAve you prepared ?

If I ever get it I will frame it, so it will cost thee nowt.

Cornish Tart #1

Remember An Gof!

Remember An Gof!

- Yorick

- Posts: 16736

- Joined: Sat Mar 14, 2020 8:20 pm

- Location: Paradise

- Has thanked: 10263 times

- Been thanked: 6885 times

Re: Pension stuff, how's it all looking ? HAve you prepared ?

Cousin Jack wrote: ↑Thu May 09, 2024 8:43 amIf I ever get it I will frame it, so it will cost thee nowt.Yorick wrote: ↑Wed May 08, 2024 10:09 pmI'll send a cheque in the post.Cousin Jack wrote: ↑Wed May 08, 2024 9:48 pm

Of course you can, the price is a bit higher though.

£10 pw, with an initial deposit of £50.

- Pirahna

- Posts: 1945

- Joined: Wed Mar 25, 2020 7:31 pm

- Has thanked: 1814 times

- Been thanked: 1164 times

Re: Pension stuff, how's it all looking ? HAve you prepared ?

I use a crowd called Wealth at Work, the setup fees weren't cheap but they've paid it back many times over. For me they've definitely been worth it.

- weeksy

- Site Admin

- Posts: 23417

- Joined: Sat Mar 14, 2020 12:08 pm

- Has thanked: 5450 times

- Been thanked: 13085 times

Re: Pension stuff, how's it all looking ? HAve you prepared ?

And how did you find them and decide they were a good option ?

- Count Steer

- Posts: 11805

- Joined: Mon Jul 19, 2021 4:59 pm

- Has thanked: 6376 times

- Been thanked: 4751 times

Re: Pension stuff, how's it all looking ? HAve you prepared ?

There are some options but it sounds like all you need is a review and some advice/information. My concern would be an IFA will be delighted to say 'Take the 25% lump and invest it in these products that I get commission on'. As far as I know though you can pay them a fee and then what you buy doesn't get them commission. If they're 'free' then they have to make money somehow, they're in business to make money.weeksy wrote: ↑Thu May 09, 2024 7:49 am I guess as an ongoing question then within this.

IFAs, how do you find/pick one ? Are they actually worth having ?

Essentially i have a few ideas looking at my pension, mortgage and plans for when i hit 55 years. But i'd like to know if they actually have any merit.

Part of my plan is taking some/all of the 25% allocation and what to do or not do with that... If i don't spend it all, would i reinvest it and would reinvesting it yield more or less than leaving it in there for example.

There's no real way of knowing if you'll make (or lose) more money on investments outside your pension other than taking the money and putting it in Premium Bonds or fixed term tax free wrappers like ISAs.

Find a local IFA outfit. Look at their people on their web site, see if they have a retirement specialist and what their 'CV' looks like. Pay them up front - expect the charge to have 3 zeros+. But...first, read up on things so you go into the conversation clued up in general terms on what and when you can pull £ out and with an idea of what you're trying to achieve. Pull together all the info on what you've got pension, mortgage, income, outgoings to present - you don't want to waste time you're paying for.

I'll see if I can find some clear info and stick up some links if I do. Fidelity send out some useful stuff.

Doubt is not a pleasant condition.

But certainty is an absurd one.

Voltaire

But certainty is an absurd one.

Voltaire

- Count Steer

- Posts: 11805

- Joined: Mon Jul 19, 2021 4:59 pm

- Has thanked: 6376 times

- Been thanked: 4751 times

Re: Pension stuff, how's it all looking ? HAve you prepared ?

Oh. I'd also probably start with the really free one. Pensionwise. I've used the service and it's pretty straight advice/info. I haven't done the full appointment thing but it looks like a good first step.

https://www.moneyhelper.org.uk/en/pensi ... nsion-wise

Options for taking money out

https://www.moneyhelper.org.uk/en/pensi ... on-options

https://www.moneyhelper.org.uk/en/pensi ... nsion-wise

Options for taking money out

https://www.moneyhelper.org.uk/en/pensi ... on-options

Doubt is not a pleasant condition.

But certainty is an absurd one.

Voltaire

But certainty is an absurd one.

Voltaire

- Taipan

- Posts: 13945

- Joined: Sat Mar 14, 2020 1:48 pm

- Location: Essex Riviera!

- Has thanked: 15949 times

- Been thanked: 10243 times

Re: Pension stuff, how's it all looking ? HAve you prepared ?

He's from Yorkshire, so it'll be some time before he gets over the postage costs...Cousin Jack wrote: ↑Thu May 09, 2024 8:43 amIf I ever get it I will frame it, so it will cost thee nowt.Yorick wrote: ↑Wed May 08, 2024 10:09 pmI'll send a cheque in the post.Cousin Jack wrote: ↑Wed May 08, 2024 9:48 pm

Of course you can, the price is a bit higher though.

£10 pw, with an initial deposit of £50.

-

Mr. Dazzle

- Posts: 13937

- Joined: Mon Mar 16, 2020 7:57 pm

- Location: Milton Keynes

- Has thanked: 2550 times

- Been thanked: 6244 times

Re: Pension stuff, how's it all looking ? HAve you prepared ?

Every company I've ever worked for which has a pension scheme also has a pensions advice service, maybe start there?

They're naturally going to be biased though of course.

They're naturally going to be biased though of course.

- Count Steer

- Posts: 11805

- Joined: Mon Jul 19, 2021 4:59 pm

- Has thanked: 6376 times

- Been thanked: 4751 times

Re: Pension stuff, how's it all looking ? HAve you prepared ?

Taking tax free cash from a pension.

https://retirement.fidelity.co.uk/acces ... tax%20free.

As Dazzle says, your company may also have an allocated advisor.

https://retirement.fidelity.co.uk/acces ... tax%20free.

As Dazzle says, your company may also have an allocated advisor.

Doubt is not a pleasant condition.

But certainty is an absurd one.

Voltaire

But certainty is an absurd one.

Voltaire

- weeksy

- Site Admin

- Posts: 23417

- Joined: Sat Mar 14, 2020 12:08 pm

- Has thanked: 5450 times

- Been thanked: 13085 times

- Cousin Jack

- Posts: 4452

- Joined: Mon Mar 16, 2020 4:36 pm

- Location: Down in the Duchy

- Has thanked: 2550 times

- Been thanked: 2285 times

Re: Pension stuff, how's it all looking ? HAve you prepared ?

He will also lose his Yorkshire credentials. I know how to pay in a check via an app, get the money and still frame the paper cheque.Taipan wrote: ↑Thu May 09, 2024 9:48 amHe's from Yorkshire, so it'll be some time before he gets over the postage costs...Cousin Jack wrote: ↑Thu May 09, 2024 8:43 amIf I ever get it I will frame it, so it will cost thee nowt.

Cornish Tart #1

Remember An Gof!

Remember An Gof!

-

v8-powered

- Posts: 2527

- Joined: Mon Mar 16, 2020 7:37 pm

- Location: Layer-de-la-Haye

- Has thanked: 2248 times

- Been thanked: 1242 times

Re: Pension stuff, how's it all looking ? HAve you prepared ?

My wife, who's partner in an IFA business, deals with this kind of thing on a regular basis - folks duped in to investing their pension pots in to wine, cigars, whisky, overseas property etc. Funnily enough all lose their cash despite professional advice.....