Even I’m bigger and stronger than most women. They are my equals as examples of humanity.Potter wrote: ↑Sat Jul 01, 2023 1:48 pm It's a biological fact that I'm stronger than the average woman, but if, for the sake of peace, I have to pretend that women are equal to me, then women can pretend that a man in a dress is equal to them.

Otherwise lets just do away with all this nonsense and leave it to how nature intended it to be.

In todays news...

-

JackyJoll

- Posts: 3741

- Joined: Sun May 03, 2020 10:11 pm

- Has thanked: 261 times

- Been thanked: 1266 times

Re: In todays news...

- Horse

- Posts: 11563

- Joined: Sun Mar 15, 2020 11:30 am

- Location: Always sunny southern England

- Has thanked: 6200 times

- Been thanked: 5090 times

Re: In todays news...

We recently had an interesting article on the company intranet, written by a colleague who is bisexual. The gist being that, contrary to experiences elsewhere, he was simply accepted by us all.

However, could the use of 'support' be meant as 'not being against'?

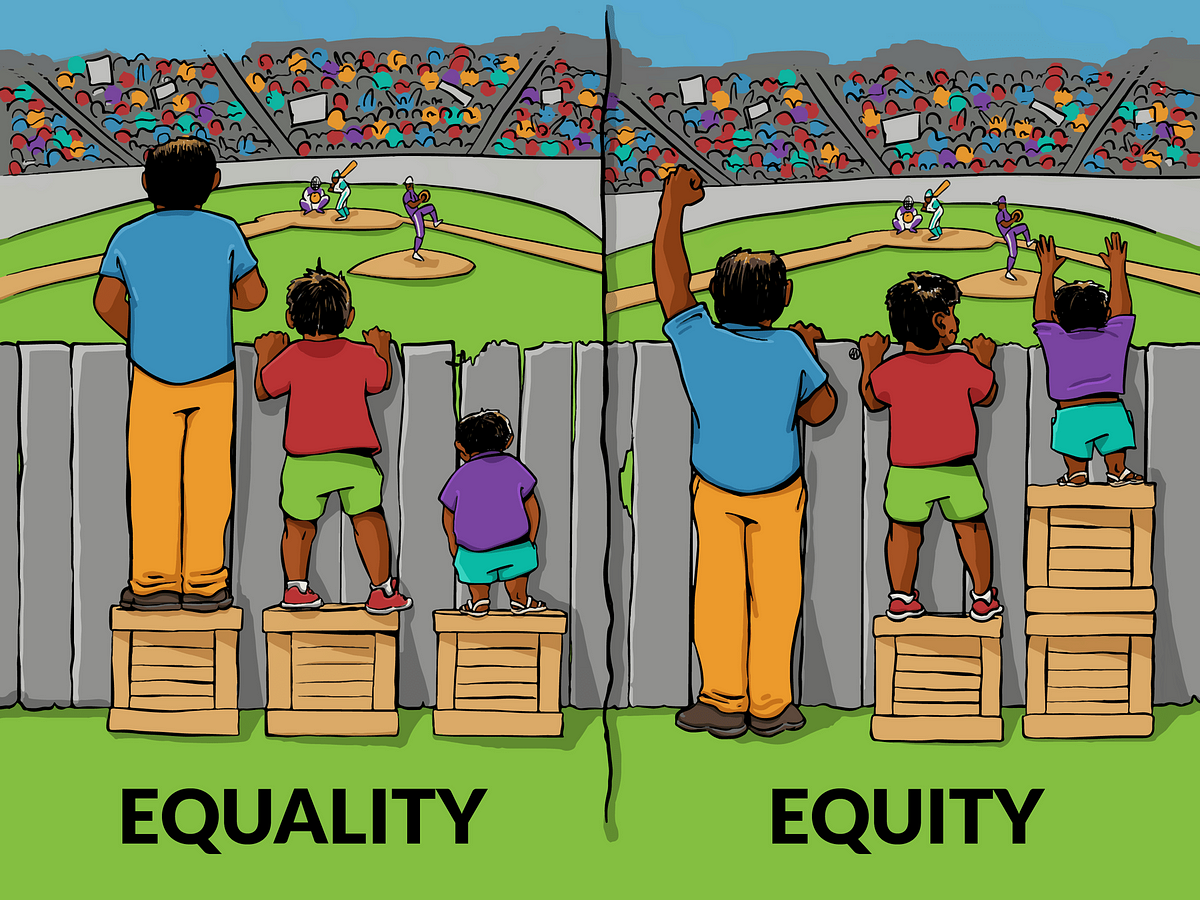

As an aside, I was surprised to learn that 'equality' actually means 'equity', more towards equitable outcomes rather than equal provision.I do feel strongly that everyone is equal and we all have equal rights.

Even bland can be a type of character

-

Bigjawa

- Posts: 1931

- Joined: Mon Jun 01, 2020 10:54 pm

- Location: Ballymena Co. Antrim

- Has thanked: 221 times

- Been thanked: 878 times

-

Mussels

- Posts: 4446

- Joined: Mon Mar 16, 2020 9:02 pm

- Has thanked: 839 times

- Been thanked: 1242 times

Re: In todays news...

It doesn't but it's another definition some people are trying to distort, otherwise we'd have equity laws and the RAF woudn't have been found to be breaching equality laws.

-

JackyJoll

- Posts: 3741

- Joined: Sun May 03, 2020 10:11 pm

- Has thanked: 261 times

- Been thanked: 1266 times

Re: In todays news...

Putting on a frock isn’t a human condition. It’s something people do, for reasons.

- Cousin Jack

- Posts: 4475

- Joined: Mon Mar 16, 2020 4:36 pm

- Location: Down in the Duchy

- Has thanked: 2561 times

- Been thanked: 2290 times

Re: In todays news...

That ^ is the bollox. I am all for equal treatment but equality of outcome means either handicapping the good, or giving the less good an unfair advantage.

Education made that mistake 30 years ago, no competitive sports because otherwise some would lose, examinations became non- competitive ( and dumbed down) so that almost everyone got top grades. Degrees for everyone. We are still suffering today.

Cornish Tart #1

Remember An Gof!

Remember An Gof!

- Yambo

- Posts: 2470

- Joined: Mon Mar 16, 2020 8:08 pm

- Location: Self Isolating

- Has thanked: 598 times

- Been thanked: 1647 times

Re: In todays news...

^^^^^

There are no advantages for educators to give poor grades.

There are a remarkable number of unintelligent teachers nowadays.

There are no advantages for educators to give poor grades.

There are a remarkable number of unintelligent teachers nowadays.

- Horse

- Posts: 11563

- Joined: Sun Mar 15, 2020 11:30 am

- Location: Always sunny southern England

- Has thanked: 6200 times

- Been thanked: 5090 times

Re: In todays news...

Perhaps a poor explanation on my part.Cousin Jack wrote: ↑Sat Jul 01, 2023 3:39 pmThat ^ is the bollox. I am all for equal treatment but equality of outcome means either handicapping the good, or giving the less good an unfair advantage

Even bland can be a type of character

Re: In todays news...

That's what has happened with all of this equality stuff, it's just discriminated out the people actually good at the work, in favour of employing people simply because of the colour of their skin. The end result, we don't really have the right people in certain positions. Attributes have nothing to do with what someone looks like and I think people are slowly starting to realise that. Once companies and technology fails, it's too late - we don't want it to get that far, but we're not that far off it.Cousin Jack wrote: ↑Sat Jul 01, 2023 3:39 pmThat ^ is the bollox. I am all for equal treatment but equality of outcome means either handicapping the good, or giving the less good an unfair advantage.

Education made that mistake 30 years ago, no competitive sports because otherwise some would lose, examinations became non- competitive ( and dumbed down) so that almost everyone got top grades. Degrees for everyone. We are still suffering today.

-

MyLittleStudPony

- Posts: 1157

- Joined: Sat Mar 14, 2020 9:28 pm

- Has thanked: 620 times

- Been thanked: 407 times

Re: In todays news...

I wonder if it is more fear than hate. Or perhaps hate born of fear. Not unusual in old straight cis white men.

Re: In todays news...

Or women. Fear, yes. Say it's a woman who's worried about a man in a dress following her into the toilets?

12 year old girl has a man in a dress follow her into the toilets, because a man is allowed to if he identifies as a woman.

I can't say that as a man, I'm in a position to tell a vulnerable girl or an afraid woman that they're being irrational whilst their rights which have been fought for over the years, are now being eroded, by men.

In the 1920s we had the suffragettes, In the 2020's, we're wilfully undoing all of their hard work.

12 year old girl has a man in a dress follow her into the toilets, because a man is allowed to if he identifies as a woman.

I can't say that as a man, I'm in a position to tell a vulnerable girl or an afraid woman that they're being irrational whilst their rights which have been fought for over the years, are now being eroded, by men.

In the 1920s we had the suffragettes, In the 2020's, we're wilfully undoing all of their hard work.

- Cousin Jack

- Posts: 4475

- Joined: Mon Mar 16, 2020 4:36 pm

- Location: Down in the Duchy

- Has thanked: 2561 times

- Been thanked: 2290 times

Re: In todays news...

And I have no real problem with that. What I do have a real problem with is selecting the little one for a basketball team, when the basic requirement is to be 6' 6" or more tall. He may want to play basketball, he may be fit, have good ball skills, and be fast, but he will never, ever, outjump someone 7 feet tall.

Cornish Tart #1

Remember An Gof!

Remember An Gof!

- Horse

- Posts: 11563

- Joined: Sun Mar 15, 2020 11:30 am

- Location: Always sunny southern England

- Has thanked: 6200 times

- Been thanked: 5090 times

Re: In todays news...

Thank you, because that's the only thing I was trying to put across.

Even bland can be a type of character

-

Mussels

- Posts: 4446

- Joined: Mon Mar 16, 2020 9:02 pm

- Has thanked: 839 times

- Been thanked: 1242 times

Re: In todays news...

Nice graphic but utterly irrelevant when it comes to diversity quotas where somebody has to lose out.

- Horse

- Posts: 11563

- Joined: Sun Mar 15, 2020 11:30 am

- Location: Always sunny southern England

- Has thanked: 6200 times

- Been thanked: 5090 times

Re: In todays news...

Which was why my original post was in two parts, with the equality/equity bit introduced as an aside - i.e. not directly relevant.

Even bland can be a type of character

- MrLongbeard

- Posts: 4602

- Joined: Sun Mar 15, 2020 2:06 pm

- Has thanked: 600 times

- Been thanked: 2451 times

Re: In todays news...

If they'd have done better in school they could have bought a ticket and done away with the the whole issue instead of trying to get a free watch of the game.

- Horse

- Posts: 11563

- Joined: Sun Mar 15, 2020 11:30 am

- Location: Always sunny southern England

- Has thanked: 6200 times

- Been thanked: 5090 times

Re: In todays news...

Thought you were going to say " ... been taller"

That's actually just part of a bigger graphic.

Even bland can be a type of character

- Yorick

- Posts: 16754

- Joined: Sat Mar 14, 2020 8:20 pm

- Location: Paradise

- Has thanked: 10279 times

- Been thanked: 6891 times

Re: In todays news...

OooooooohMrLongbeard wrote: ↑Sat Jul 01, 2023 10:18 pmIf they'd have done better in school they could have bought a ticket and done away with the the whole issue instead of trying to get a free watch of the game.

- irie

- Posts: 2769

- Joined: Sat Mar 14, 2020 1:09 pm

- Location: Noviomagus Reginorum

- Has thanked: 1482 times

- Been thanked: 411 times

Re: In todays news...

I believe Macron has called in the GIGN to regain control of cities with riots.

https://en.m.wikipedia.org/wiki/GIGN

Will almost certainly put a lid on the current protests, but only temporarily.

https://en.m.wikipedia.org/wiki/GIGN

Will almost certainly put a lid on the current protests, but only temporarily.

"Truth does not change because it is, or is not, believed by a majority of the people." - Giordano Bruno

- Screwdriver

- Posts: 2162

- Joined: Sun Aug 09, 2020 12:15 pm

- Location: Wherever I lay my hat, that's my hat...

- Has thanked: 256 times

- Been thanked: 740 times

Re: In todays news...

One of the big problems with the alphabet people is that it has attracted sexual deviants and perverts who have nowhere else to go. It's a bit like a similar phenomena in right wing politics which attracts the (minority) subset of extremophiles, Nazi supporters and proper old school racists.

There was recently a rather obvious clue when during a "pride" march, they started chanting "we're coming for your children..."

Similar to the political ambitions of the left wing where they have a strategy of indoctrination aimed at children, the same playbook is being used by LGBTQ+ to sexualise children and promote sexual deviancy. While that indoctrination on the face of it might be said to be some sort of information campaign, it is tantamount to grooming and is being used as such by people who have an unhealthy attitude towards youngsters.

There was recently a rather obvious clue when during a "pride" march, they started chanting "we're coming for your children..."

Similar to the political ambitions of the left wing where they have a strategy of indoctrination aimed at children, the same playbook is being used by LGBTQ+ to sexualise children and promote sexual deviancy. While that indoctrination on the face of it might be said to be some sort of information campaign, it is tantamount to grooming and is being used as such by people who have an unhealthy attitude towards youngsters.

“No one is more hated than he who speaks the truth.”

Plato

Plato